Following a meeting of the WPTC (World processing tomato council) including most AMITOM country representatives (tomato growers association), the new crop pricing was discussed and various factors were examined to clarify the reason behind the large increases that we are seeing from all origins this year.

Below is a summary of the auxiliary factors in the calculations, which should help to break down the cost model and explain the increases:

4x cost increase for gas consumption

2.5x cost increase for electricity

30% increase on labour costs

Double cost on tins since last season

50% increase on paper and card

100% increase on shrink wraps

4x increase on citric acid

Production will commence at the end of July/early August, the anticipated crop predictions indicate 20% less crop availability than last season.

No carry over stock, in particular on 3kg/400g plum, the market has never been this short of these 2 lines. Chopped 400g/3kg will be exhausted by the time the new season starts. Sales in foodservices is also on the rise following the end of restrictions. This is hugely impacting the demand.

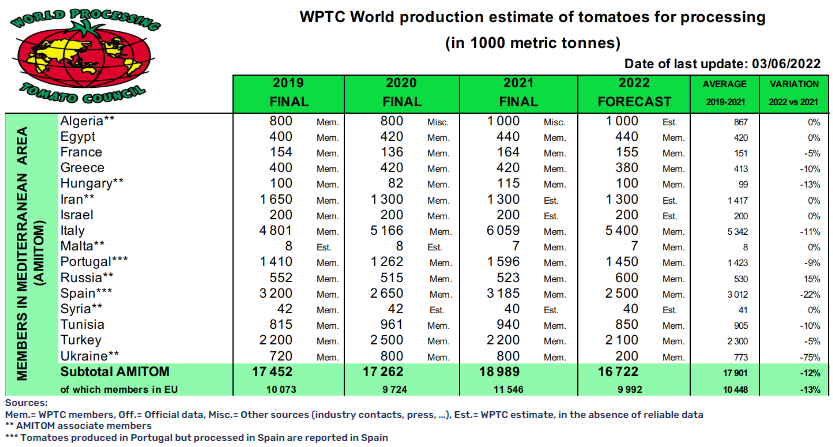

As can be seen in the table, all major European/North African growing regions will see either a decline, or a flat performance on tomato crop success this year.

What is absolutely crucial here is the Spanish numbers showing a 22% decrease in raw material. This combined with the auxiliary factors is of huge significance. Ukraine numbers are also disastrous as expected following the conflict with Russia, while Russia is the only country to see an increase in forecast.

Elsewhere, California has seen a 9% increase in output, which gives the USA a very advantageous position in the tomato market, many market experts are expecting a rise in export from the US to European countries.

ITALY

North:

To date about 92% of the expected surfaces have already been planted (lower input than last year) and operations should end by mid-June.

Weather has been hot, accelerating the crop

Storms have already damaged approximately 400 ha.

Water availability may be an issue.

Centre/South:

Pricing not yet agreed: contracts need to be signed ASAP.

Input lower than last year due to farmers growing competing/alternative crops.

PORTUGAL

Planting is virtually finished now and has generally gone well despite a few interruptions due to rain. In general, the fields are looking good.

Some farmers did not plant this year, but the reduction should not be significant.

SPAIN

Weather conditions have been a key factor in the challenges this year.

Water is not available, and competing crops are an easier/more lucrative option for farmers.

Planting in Extremadura was delayed by about a week due to rains. Also a heat wave was observed (Up to 34-37°C).

In Andalusia the harvest will be starting a month later than usual, in early August.

TUNISIA

At 30th May, 12,206 hectares of tomatoes have been planted.

Yields should be lower than expected at 70-80 t/ha, but higher than 2021.

A total of 850,000 tonnes is now expected to be processed (with a yield of 70 t/ha).

TURKEY

Late planting due to delays in other competitive crops.

Slow development due to cooler temperatures.

Harvest expected in late August.

GREECE

Some hail storms have damaged the current crop, damage assessment still underway.

Some disease development is concerning growers. Small areas will be replanted.

The forecast remains the already reduced volume of 380,000 tonnes.