In today’s fast-paced world, it is easy to ask: “Does consumer behaviour really matter to a business like ours in food ingredients?” Given the multiple layers between us and the end consumer, should we adapt to shifting consumer patterns, or merely respond to demand fluctuations as they arise? Let us dive in and find out.

The Domino Effect on the Food Chain

While retailers and brands are the ones directly interacting with consumers, they’re not the only ones affected by shifts in consumer behaviour. Think of it like a domino effect. When a significant change occurs, it sends shockwaves throughout the entire food supply chain. Indeed, the past few years have been quite the rollercoaster.

Events Shaping Consumer Behaviour

What sets the past few years apart from preceding decades is the frequency and magnitude of events affecting consumer behaviour. The ongoing cost of living crisis, for instance, has altered numerous consumer trends once deemed permanent. For industry veterans, the challenges of recent years are unparalleled. The current crisis has a more profound effect on consumer purchasing habits than the 2008 financial downturn. Are consumers now more adaptable due to recent upheavals, or is the sheer scale of the crisis leaving them with no choice but to evolve?

Turning our attention to Food Inflation

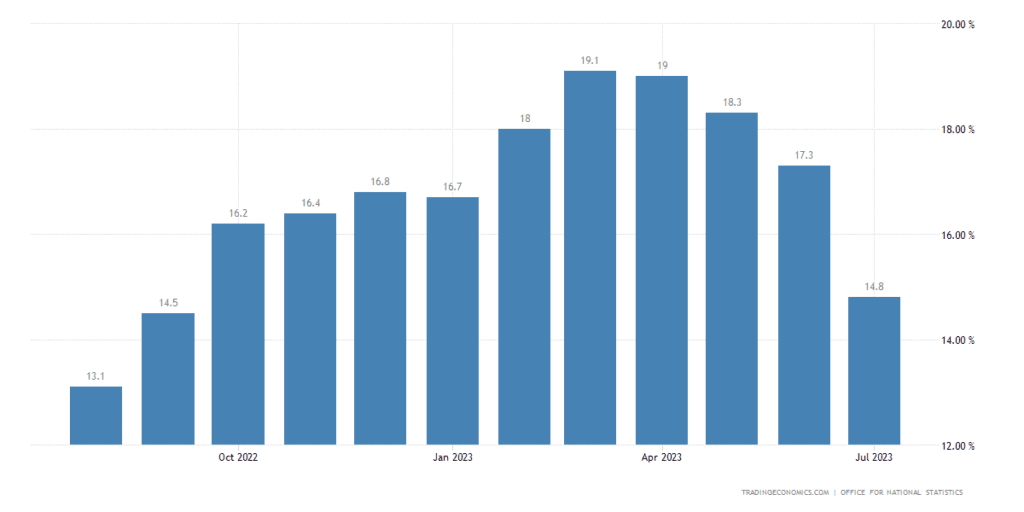

From an economic lens, it is intriguing to observe the factors fuelling the cost-of-living crisis. Food inflation, among other elements, has played its part. Within our industry, we foresaw the inflationary impact long before it manifested on supermarket shelves. Take pasta, for instance. In 2021, a subpar crop yield, exacerbated by wildfires in Canada, led to a surge in semolina prices. Although 2022 promised better crops, the geopolitical turmoil in Ukraine disrupted the food commodities market. Coupled with energy price hikes and a weak exchange rate due to UK’s political instability, the cost of importing food soared.

From an economic lens, it is intriguing to observe the factors fuelling the cost-of-living crisis. Food inflation, among other elements, has played its part. Within our industry, we foresaw the inflationary impact long before it manifested on supermarket shelves. Take pasta, for instance. In 2021, a subpar crop yield, exacerbated by wildfires in Canada, led to a surge in semolina prices. Although 2022 promised better crops, the geopolitical turmoil in Ukraine disrupted the food commodities market. Coupled with energy price hikes and a weak exchange rate due to UK’s political instability, the cost of importing food soared.

While pasta is just one example, 2022 witnessed inflation across all food commodities. Although 2023 shows signs of improvement, a “new normal” has emerged in food pricing, with deflation seeming slow to arrive.

Impacts on the Food Ingredients Marketplace

The changes in consumer behaviour have had some significant effects on our industry. Remember the lockdowns? While food service sales took a hit, retailers and recipe box delivery services saw a surge as everyone suddenly became home chefs. And speaking of past trends, doesn’t it take you back to 2008, for instance back then meat seasonings suddenly gained immense popularity as many sought to enhance cheaper meat cuts. Times and patterns change, but it remains fascinating to see how consumer behaviour shapes market demands.

Consumer adaptations to these economic pressures are evident. The rise of discounters like Aldi, which now holds 10% market share just shows that consumers are continuing to switch to more cost-effective alternatives. The shift from chilled to frozen foods, and a preference for home-cooked meals over ready meals are just a few other examples.

On an anecdotal note, the recipe box market, which saw tremendous growth over the past few years, has slowed down. The switch from brands to own label is also well documented in helping consumers save money. Reports suggest consumers have been successful in cutting their food bills and on average mitigated around half of the food inflation they have experienced.

Time will tell how established these new behaviours will become, but with interest rates looking to remain high for years rather than months and economic performance looking sluggish at best, it is safer to assume belt-tightening will continue for the next few years.

The once-booming trend of vegan and plant-based consumption has seen a slowdown. Some businesses that initially benefited from skyrocketing demand have now faced challenges as demand has not remained at pre-pandemic levels. Many consumers, during the pandemic, reverted to traditional comfort foods, and the perceived value of plant-based alternatives, especially when they can be pricier than meat, has been questioned.

We have recently been challenged as to whether we could sell some plant-based alternatives. Whilst the products are interesting the demand for them within our customer base is much reduced, and as they are often much more expensive than what is already available in a very crowded marketplace there is not much interest within the manufacturing space.

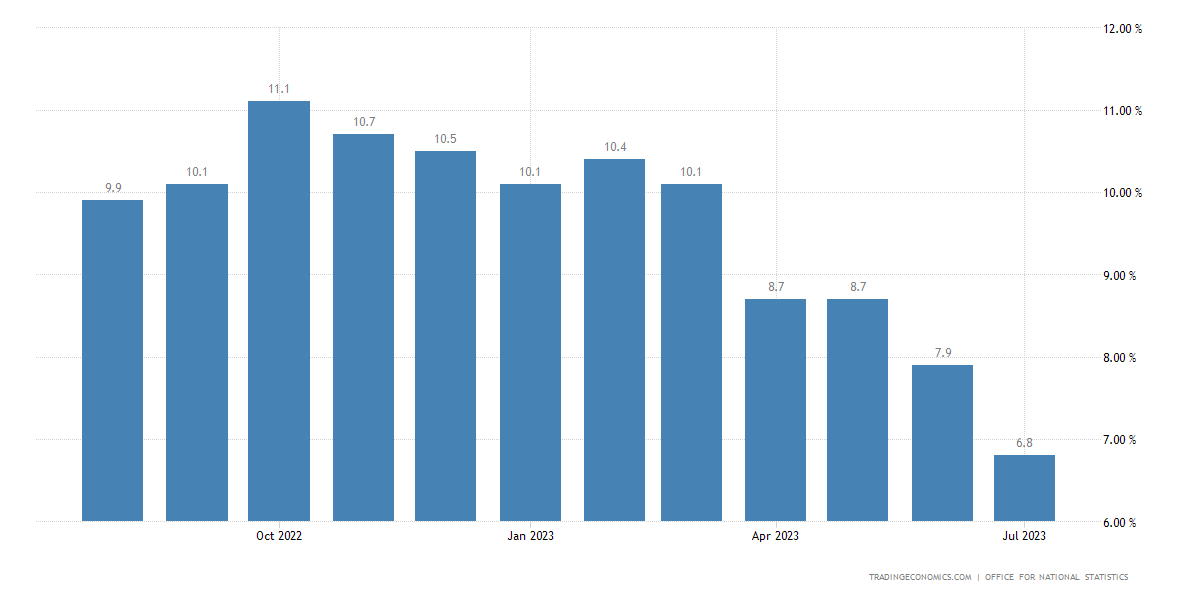

Consumer price inflation in the UK dropped to 6.8% in July 2023 to the lowest level since February 2022 mainly due to a slump in fuel prices.

Navigating the Current Landscape

Retailers’ reactions to consumer behaviour often have a more profound impact on the supply chain than direct consumer demand. In the face of inflation, the entire supply chain has been striving to mitigate costs, whether through recipe modifications or process enhancements.

As the opportunities to remove costs become more difficult to find, increased collaboration is required to access those benefits. With margins throughout the supply chain becoming tighter, recovering inflation becomes critical, and facilitating this through increased transparency of costs between retailer and manufacturer has become more commonplace.

Supporting the manufacturers to understand how inflation has driven their ingredient costs is therefore the next logical step in the chain and a challenge for the industry to embrace.

Reacting to Market Changes: Strategies for Growth

There has been a slackening of demand for certain commodity products which corresponds to the overall reduction in retailer volume demand. With reduced demand for volume and the economic climate not set to grow substantially for the foreseeable future, organic growth may be a little harder to come by than normal. So how to sustain growth in a stagnant market, there are a few choices;

- Diversify: Exploring new markets or products can be risky but potentially rewarding.

- Innovate: Instead of chasing the next big thing, why not improve on what’s already there? Maybe offer products that customers currently source elsewhere.

- Expand: Take your products to adjacent markets. What works for one group might just work for another.

- Deepen Relationships: If you’re already a market leader, focus on strengthening existing relationships. Understand your customers’ needs and cater to them.

Regardless of the strategy, the consumer remains the ultimate determinant of a business’s success throughout the value chain and no matter how distant we perceive ourselves from the end consumer, their choices shape our industry’s trajectory.

If you understand the reasons your customers purchase from you and remain loyal, then concentrating on those attributes and consistently delivering on them – while also presenting them to a broader customer base – should guide you towards growth.

If you’d like to discuss your business and how we could partner to grow, reach out directly to our Commercial Director Julian Key